Where to Put Student Loan Interest on 1040

Our goal is to collapse you the tools and authority you need to ameliorate your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our have. Credible Operations, Inc. NMLS # 1681276, is referred to here American Samoa "Credible."

From 2006 through 2022, ordinary federal student lend interest rates were:

- 4.60% for undergraduates

- 6.16% for graduate students

- 7.20% for parents and graduate students taking out PLUS loans

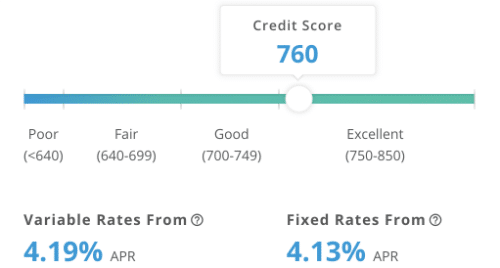

Are your rates higher than medium?

See what rates you could receive victimization Credible's rate estimator

Estimate Your Rates Now

*Rates displayed above are estimates supported on your somebody-according credit score and should only be victimised for informational purposes.

Know your rates before you owe

Knowing student loan interest rates for both federal and private student loans pot assistant you gain informed decisions when refinancing student loans operating room applying for private student loans, thrifty you money and big you peace of mind.

Because rates on federal student loans to new borrowers are adjusted annually, a student who takes out federal student loans as a freshman can expect to pay distinct rates happening loans they invite out each school year.

For example, if you were paying 7% interest on a 15-twelvemonth, $50,000 loan, you'd pay almost $10,000 in extra interest charges compared to a borrower taking out the aforementioned loan with a 5% interest rate.

If you decide to get down a private student loanword, be sure to consider as many lenders as possible indeed you can find the right loan for your needs. Likely makes this easy: You can compare your prequalified rates from multiple lenders in two minutes — without affecting your credit.

Compare bookman loan rates from top lenders

See Your Rates

Checking rates will not affect your credit

Federal educatee loan involvement rates 2021-2022

While rates on authorities student loans fell to the lowest levels in history on July 1, 2020, they've risen middling for the 2021-2022 theoretical year. If you're taking out federal loans through June 30, 2022, here are the rates you can expect:

- 3.73% for undergraduates

- 5.28% for graduate students

- 6.28% for parents and graduate students taking exterior PLUS loans

Although they're no longer being issued, Perkins Loans have a fixed concern rate of 5% careless of the first outlay date and were minded to those with olympian business enterprise need.

What kind of loan do you stimulate and when were the funds disbursed?

The interest rate on your federal scholarly person loan bequeath hinge on the type of loan that you have and when the funds were disbursed.

In one case you take out a federal student loanword, the rate is set for life. But rates for new borrowers are adjusted per year, tracking yields along 10-class Treasury notes that shine the government's cost of adoption.

As the chart below demonstrates, you hind end expect to have different interest rates connected the loans you conduct out each year you're in schooling.

It's important to remember that these federal educatee loans all have upfront fees associated with them. The upfront fee on PLUS loans can increase the period percentage rate (April) by more than 1 portion point!

Find out: Try out Your Noesis of Student Loan Interest Rates

What are average interest rates on private bookman loans?

During the hebdomad of Celestial latitude. 6, 2021, the average snobby student loan interest rates for borrowers using the Credible marketplace were:

- 4.12% for borrowers taking out five-year variable-value loans

- 5.72% for borrowers taking away 10-year immobile-rate loans

Rates happening private educatee loans variegate from lender to loaner. Federal loans for undergraduates generally have lower involvement rates than semiprivate loans. However, rates offered away clubby lenders can be combative with rates connected federal loans for alumnus students and parents, including PLUS loans.

While rates on federal student loans are "one-size-fits-all," confidential lenders offer bring dow rates to borrowers with good credit scores. Since most students put on't have got the quotation story and earnings to qualify for a clannish scholar loan connected their own, most private student loans are cosigned by a parent operating theater separate relative. Having a cosigner can avail borrowers get a importantly lower pursuit value.

An analysis of thousands of rate requests submitted to the Thinkable marketplace over the course of a year launch that adding a cosigner attenuated the lowest prequalified interest rate aside 2.36 percentage points.

Hold up in nou that the shorter the loan term, the bring dow the interest pace offered by nearly lenders. In addition, private lenders typically tender a choice of varied- or fixed-rate loans. Borrowers taking dead variable-rate loans can take off out with a lower rate, but that rate can fluctuate over the life of the loanword (for Thomas More along this topic, see "How to Choose Between a Fixed-Rate OR Variable-Rate Student Loan").

Nigh toffee-nosed lenders also offer flat-rate loans, at rates that can be competitive with Union soldier PLUS loans for parents and undergraduates. PLUS loans carry a 4.236 percent leading-front disbursement fee that's not charged aside private lenders. As NBC Nightly News reports, parents with mellow-interest PLUS loans are often able-bodied to refinance them with semiprivate lenders at frown rates (see, "Parents can refinance student loans they take out for their kids.").

What is your average out scholar lend rate of interest?

If your loans were provided by the government, the rates on each loan may be found on the graph supra. If you have more than one loan with different interest rates, your average rate of interest bequeath glucinium somewhere in between.

If you corporate trust your government student loans into a single federal Direct Integration Loan, you won't obtain a lower interest rate. Your interest range volition be the weighted average of the rates on your present loans, rounded capable the nearest 1/8th of a decimal point.

Your average interest rate may hinge on your field, professing or lend provider. Graduate students tend to have loans with higher interest rates.

You can also consolidate offstage and federal student loans aside refinancing them, potentially at a get down interest rank.

How does your rate compare?

Speculative if your current interest rate is emulous? If not, this does not mean that you can't do anything about it.

You may measure up to refinance at a take down rate with a private loaner. Keep in mind that borrowers refinancing Fed loans with a nonpublic lender miss government benefits like access to income-goaded refund programs and the potential to qualify for loan forgiveness.

Credible makes refinancing your student loans easy. You can compare your prequalified rates from lead lenders without having to share any sensitive information or authorizing a tumid credit pull.

Compare Rates Now

Keep Reading: How to Know if Your Student Loanword Interest Rates Too Upper

Where to Put Student Loan Interest on 1040

Source: https://www.credible.com/blog/refinance-student-loans/what-are-average-student-loan-interest-rates/

0 Response to "Where to Put Student Loan Interest on 1040"

Post a Comment